If you do not wish to join via the app, please phone our office and one of the team would be happy to make an alternative arrangement via phone or office appointment.

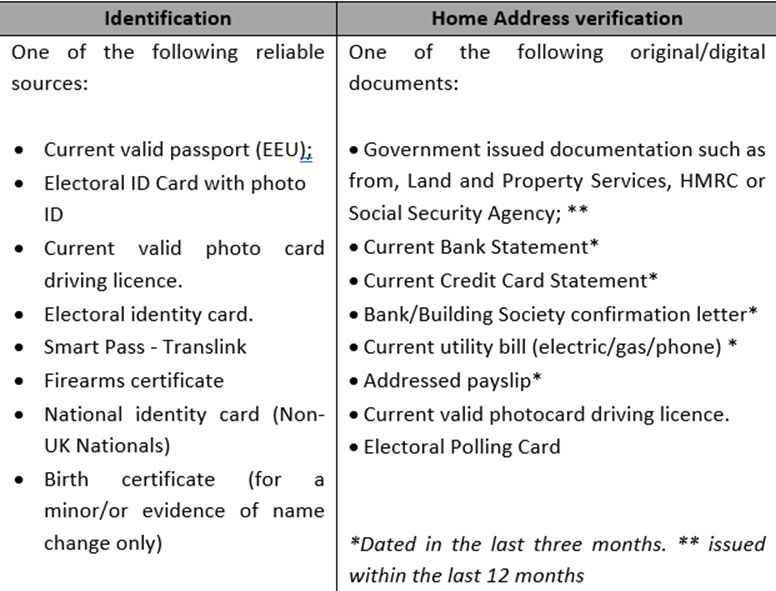

A valid photographic ID (e.g., Driving Licence, Passport, Senior Smart Pass) in addition to a separate Proof of Address dated within the last 3 months (e.g., bank statement, utility bill or government agency letter).

All eligible members of the Credit Union can apply for insurance covered under our Death Benefit Insurance Policy. This means in the event of your death, a lump sum of £2,500 will be paid to your family to help with the cost of funeral expenses, thereby easing the financial burden of bereavement. This insurance is deductible directly from your credit union account on a half yearly basis, please speak to a member of staff for this year’s premium.

Nobody enjoys talking or even thinking about their own mortality. However, the simple fact is funerals are now extremely expensive and very few people realise the impact funeral bills will have on their lives. In recent years the average cost of a funeral has increased to over £2,500.

Death Benefit Insurance won’t ease bereavement, but it will go a long way towards easing the financial burden your death may place upon your family. BCCU can help take a little bit of the pressure off and liaise directly with the funeral director to handle the invoice, if that is the families wish.

To qualify for death benefit insurance, you must be a Credit Union member and must have joined the Credit Union before your 70th birthday. You must insure you maintain an appropriate balance to cover the cost of the quarterly premiums.

BCCU provides LPLS insurance free of charge to all of our members, this is a perk for being with us.

Loan Protection Insurance is the insurance cover the Credit Union provides on the lives of its borrowing members.

Should an insured borrower die, or (under most contracts) become totally and permanently disabled for any occupation, the insurance cover provides that the loan is repaid in full. If a member who is eligible for insurance cover and has signed the promissory note dies with a loan outstanding, the loan balance is paid in full by the insurer.

You will be informed at the time of the loan application if your loan exceeds the amount covered by the credit unions policy. Under the basic policy death cover ceases on the members 70th birthday. The credit union has the option of extending this age limit to the members 80th birthday by affecting cover under the Over 70 Rider. Disability cover however ceases on the eligible members 60th birthday.

Life Savings Insurance is the life insurance cover the Credit Union provides for its eligible members as an additional incentive for them to save regularly. The amount of insurance benefit to which a member is entitled is in proportion to the mount of savings the member has, and depends on the members age at date of lodgement.

Age | Savings | Insurance Cover |

Under 55 | Every £1 provides* | £1 of insurance |

55 - 59 | Every £1 provides* | 75p of insurance |

60 - 64 | Every £1 provides* | 50p of insurance |

65 - 69 | Every £1 provides* | 25p of insurance |

*Up to a maximum of £10,000, shares exceeding this amount will not incur any additional benefit.

Exceptions to this include:

- lodged after age 70 (though all savings earn the dividend approved at AGM), or

- lodged whilst not in good health, or

- Withdrawals after the age of 55 will affect the amount payable as only your minimum balance will be insured.

- lodged after age 70 (though all savings earn the dividend approved at AGM), or

- lodged whilst not in good health, or

- Withdrawals after the age of 55 will affect the amount payable as only your minimum balance will be insured.

A Nomination of beneficiary is an individual over the age of 18 you would name to manage your account after your death. This person would be entitled to any funds in your account and would be in charge of dealing with the closure of the account in the event of your death.

There is only a £1 affiliation fee to join, which is then charged annually on all adult accounts.

A maximum of £20,000* for adult accounts and £10,000* for minor accounts.

*Monthly savings caps may apply.

Choose from Direct Debit, Standing Order, Electronic Funds Transfer, online card payment or call into branch.

Yes, you are required to keep a balance of £20 in your account.